The African stock market is no longer an exclusive club. Thanks to mobile technology, innovative fintech solutions, and increasing cross-border financial integration, anyone with a smartphone and as little as $10 can now build wealth by investing in African companies. Whether you’re in Lagos, Lilongwe, Lusaka, or Lamu, the power of stock market investing is at your fingertips.

This guide will show you exactly how to navigate African stock markets from anywhere on the continent. We’ll explore accessible platforms, explain how local and cross-border investments work, and provide essential tips to help you start strong, even with a modest budget.

Why Invest in Africa’s Growth Story?

Africa is experiencing rapid growth in population, urbanization, and digital adoption. This translates into significant long-term opportunities for local businesses and, consequently, for investors who buy their shares. By investing in African stock markets, you can:

- Own a piece of leading African companies: Invest in giants like Safaricom (Kenya), Dangote Cement (Nigeria), or MTN Group (South Africa).

- Generate passive income: Many companies pay dividends, offering a regular income stream.

- Grow your capital: Benefit from rising share prices as companies expand and succeed.

- Diversify your portfolio: Move beyond traditional savings accounts or real estate.

- Invest in the future of the continent: Contribute to and profit from Africa’s ongoing development.

Understanding African Stock Exchanges.

Most African countries have their own stock exchanges where local companies are listed. Here are some of the major players:

Nigerian Stock Exchange (NSE): One of Africa’s largest, featuring companies like Dangote Group, MTN Nigeria, and Zenith Bank.

Johannesburg Stock Exchange (JSE): Africa’s most developed exchange, home to major corporations such as Sasol, Shoprite, and Naspers.

Ghana Stock Exchange (GSE): Known for consistent regulation and dividend-paying stocks like GCB Bank and TotalEnergies Ghana.

Uganda Securities Exchange (USE): A growing exchange with listed firms including Stanbic Uganda and Umeme.

Rwanda Stock Exchange (RSE): A young but promising exchange that facilitates cross-border East African investments.

Historically, investing in these markets required in-person visits to brokerage firms, substantial capital, and extensive paperwork. Today, mobile apps and fintech platforms have revolutionized access.

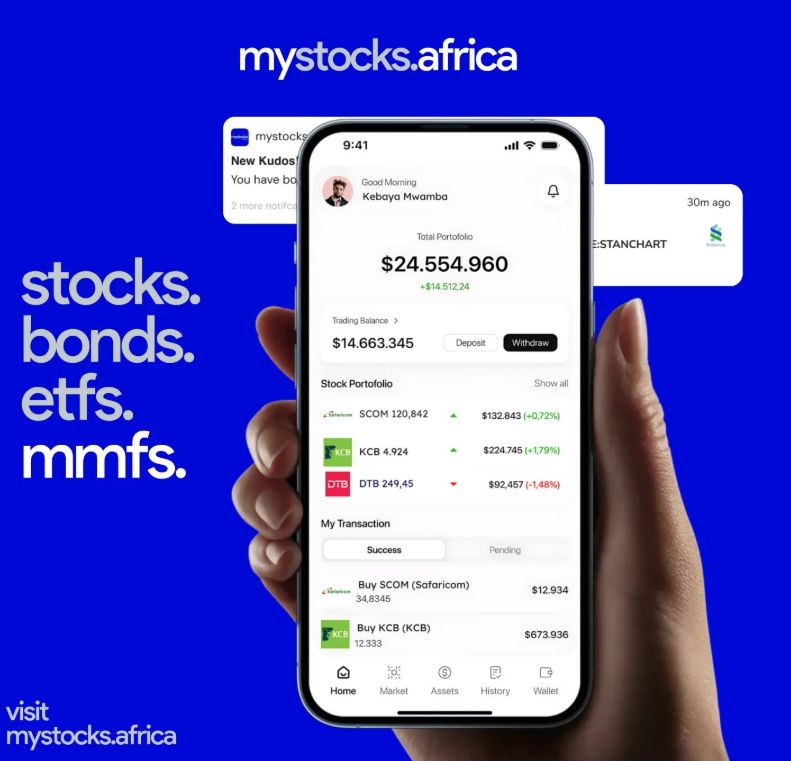

Accessible Platforms for African Stock Investing.

Several platforms are making African stock markets more accessible than ever before:

- Chaka (Nigeria): This Nigerian fintech platform provides access to both Nigerian and international markets.

- Features: Buy Nigerian equities from the NSE, invest in U.S. stocks and ETFs, fund wallets in Naira, start with as little as ₦1,000 (approx. $1.20).

- Best For: Nigerian users seeking both local and global investment opportunities.

- How to Start: Download the app, complete KYC, fund your wallet, and choose your stocks.

- African Stock Exchanges’ Online Portals & Partnerships: Many exchanges are embracing digital solutions:

- Bamboo (Nigeria): Primarily known for U.S. stocks, Bamboo now also offers Nigerian equities.

- Key Features: Access to Nigerian and U.S. stock markets, intuitive interface, educational tools for beginners.

- Best For: New African investors interested in a mix of local and U.S. stocks.

- How to Start: Sign up via app or website, verify identity, add funds, and begin buying shares.

- Note: While Nigeria-based, Bamboo is expanding, potentially offering access to other African users soon.

Investing Across African Borders.

While many apps are country-specific, several strategies facilitate cross-border investments:

- Utilize Pan-African Brokers: Platforms like African Alliance and Absa Securities operate in multiple African countries, providing access to markets in South Africa, Nigeria, Kenya, and Ghana.

- Open Brokerage Accounts Remotely: Many brokers now support online account opening. For example:

- SBG Securities (Kenya) offers online onboarding for East Africans.

- Absa (Ghana & Kenya) allows non-residents to open investment accounts.

- Requirements: Valid national ID/passport, proof of residence, bank account (local or foreign), and a minimum deposit (varies).

- Explore ETFs or Mutual Funds: For diversified exposure to multiple African stocks, consider regional ETFs or Pan-African mutual funds offered by firms such as STANLIB or Old Mutual.

Essential Tips for Beginner Investors.

- Start Small, Grow Gradually: Begin with an amount you’re comfortable losing (e.g., $10-$20) and increase your investment as your confidence grows.

- Do Your Research: Utilize company websites, stock exchange news portals, and educational resources within investment apps like Chaka and Bamboo.

- Diversify Your Portfolio: Avoid putting all your funds into a single stock or country. Spread investments across different industries (e.g., banking, agriculture, telecoms) and geographies.

- Monitor Your Investments: Use the tracking tools provided by most trading apps. Check in regularly but avoid impulsive, panic-driven selling.

- Understand Dividends: Many African companies, especially in the banking and telecommunications sectors, pay regular dividends, offering a steady income stream in addition to capital gains.

CONCLUSION.

The era of complex, inaccessible African stock investing is over. With platforms like Chaka, Bamboo, EasyEquities, and increasing digital access to local exchanges, Africans can now invest from anywhere, regardless of their budget.

Whether you’re planning for your future, building generational wealth, or simply keen to support the growth of African businesses, stock investing is a smart financial move. Start small, remain consistent, and continuously learn.

Your journey to becoming an African stock investor starts today—right from your phone.