Many of us, whether we’re students, market vendors, teachers, minibus drivers, or farmers, find managing money a bit tricky. But don’t worry! Today, I want to share a super simple way to help you plan your money better. It’s called the 50/30/20 Rule.

You might be asking, “What’s this rule all about?” Just sit back, grab your cup of tea or thobwa, and let’s talk about money the African way.

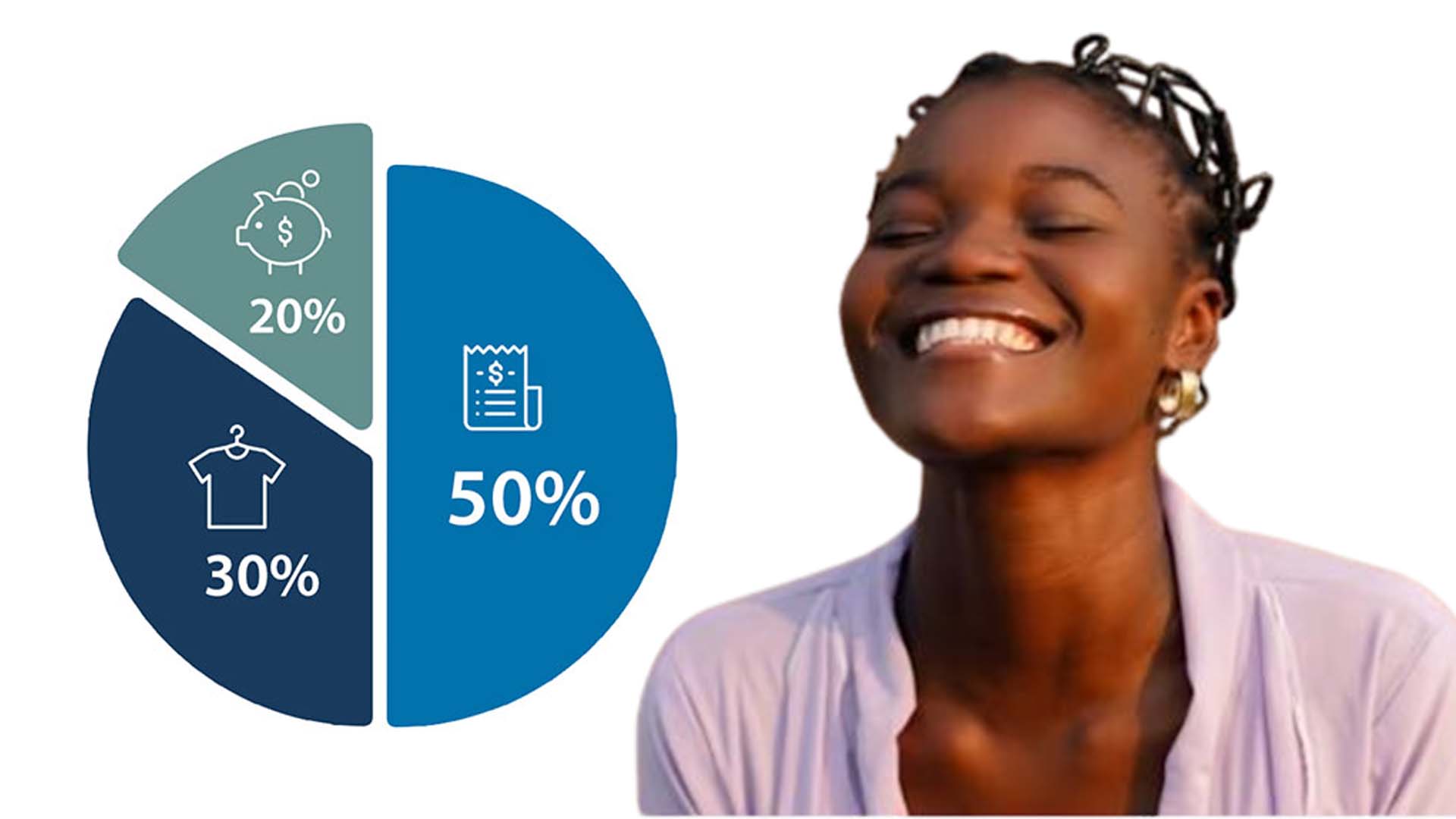

What Exactly Is the 50/30/20 Rule?

The 50/30/20 Rule is a very straightforward plan for your money. It simply tells you to split your money into three parts:

- 50% for Needs

- 30% for Wants

- 20% for Savings and Debts

That’s it! Just these three parts. Let’s dig a bit deeper into what each part means, using examples that make sense to everyone, even someone selling tomatoes by the roadside or running a small salon in the township.

1. The 50% – NEEDS (Zofunikira Kwambiri).

This is half of your money – 50% – and it should go to things you absolutely must pay for. These are your basic needs. If you don’t pay for them, life gets really tough.

Examples of Needs:

- Rent for your house or room (like if you live in Area 25 or a village in Chitipa)

- Food – nsima, vegetables, beans, cooking oil, salt

- Water bills and electricity (or paraffin if you use it for lighting)

- Transport – fuel or minibus fare to work or school

- School fees for your children

- Basic clothes – not fancy fashion, but necessary clothes like uniforms or shoes for the rainy season

Let’s say you earn K100,000 every month. With this rule, you should spend K50,000 on these needs. No more.

Quick Tip: If your needs are costing more than 50% of your income, it means you’re either spending too much or you need to change something. Maybe look for a cheaper house or buy food in bulk to save money.

2. The 30% – WANTS (Zokhumba).

Now, this part is a bit sweeter! This is the money for things you like but can live without. These aren’t bad things, but they’re not urgent necessities. They make life enjoyable, but you shouldn’t spend too much on them.

Examples of Wants:

- Eating out – like at KFC, Debonairs, or that local chambo joint

- DSTV or Netflix subscriptions

- New clothes just to look fancy or go out

- Smartphone upgrades – maybe moving from an Itel to a Samsung

- Weekend trips to the lake or nyama choma spots

- Hair & beauty – salons, nails, make-up, artificial eyelashes

So, if you earn K100,000 per month, you should only spend K30,000 on wants. If you’re spending more here, it means you’re taking money from your needs or your savings, which can be risky.

Let’s Be Real: Some of us spend more on wants than needs. Buying expensive phones while sleeping on a mat isn’t smart.

3. The 20% – SAVINGS and DEBTS (Kusunga ndi Kubweza ngongole).

This is where your future plans live! This 20% should only be used for saving money or paying off loans. Every month, at least 20% of your money should go into:

Saving Examples:

- Village Bank (banki ya mudzi)

- Buying building materials for your future house

- Starting a business – like selling fritters, cooking oil, or phone accessories

- An emergency fund – money you save for hospital visits, funerals, or sudden problems

Debt Payment Examples:

- Paying back a loan from FINCA or from a friend

- Clearing mobile loans like Airtel Money or TNM Mpamba

- Paying back shop credit (like when you buy a fridge on hire purchase)

If you make K100,000, you must save or use K20,000 to reduce your debts. Even if you only make K20,000, try to save something – even K1,000.

Village Wisdom: “Kachetechete ka m’thumba kakoma kuposa nyimbo ya m’pakamwa.” (A hidden coin in your pocket is better than loud talk with empty hands.) This means it’s better to have something saved silently than to just talk big with no money.

Why Is the 50/30/20 Rule Important in Africa?

Many of us live hand to mouth. Salary comes today, and it’s gone by next week. But this rule helps you clearly see where your money is going. Whether you’re in Malawi, Kenya, Nigeria, or Ghana, money problems often look the same.

We often:

- Help too many relatives but don’t save for ourselves.

- Borrow too much during funerals or weddings.

- Spend a lot in December, then suffer in January (the “January disease”!).

With this rule, you can start small and grow big. You don’t need to earn millions. Even someone selling airtime, doing piece work (ganyu), or running a small shop (kantemba) can use it.

How to Start Using the Rule (Even If You Don’t Earn Much).

- Write down your monthly income – the total money you receive.

- Divide it like this:

- 50% for needs

- 30% for wants

- 20% for savings or paying off debts

- Use a notebook – write down what you spend every week.

- Adjust – maybe your needs are costing too much. Try to cut down slowly.

- Discipline yourself – don’t borrow from your savings.

What If You Don’t Have a Fixed Salary?

That’s common! Many people in Malawi and other African countries do ganyu, sell things, or get paid weekly.

Even then, when you get money:

- First, remove the 20% for savings.

- Then, handle the 50% for needs.

- Use what’s left (up to 30%) for wants.

Even if you only get K2,000 today, you can save K400, spend K1,000 on needs, and use K600 for something small you like.

Conclusion – Start Small, Grow Big.

The 50/30/20 Rule isn’t about becoming rich overnight. It’s about being smart with the money you have. Whether you earn K10,000 or K1 million, it can help you plan.

Don’t say, “I’ll start when I get more money.” Start now, even with your little, and watch it grow.

As we say in Africa: “Mutu umodzi susenza denga” – One head alone can’t carry a roof. So, share this wisdom with your friends, siblings, and even your children.

Now you know the 50/30/20 rule. Are you ready to try it?